Disclaimer

This article is for informational and entertainment purposes only. It does not constitute financial advice, investment advice, or any other sort of advice. The information contained in this article reflects the author’s personal opinions and experiences and should not be considered as professional recommendations.

Cryptocurrency investments are highly speculative and carry a high level of risk. The crypto market is volatile and unpredictable. Never invest more than you can afford to lose. Always conduct your own research before making any investment decisions.

By reading and using the information in this article, you agree that the author and the website hosting this content cannot be held responsible for any financial losses or other damages you may incur as a result of your actions.

YouTube Video of $EVER Token Analysis and Everreach Tokenomics

If you’d prefer to watch a video instead of reading through the post, I’ve created a YouTube video where I dive into the key points of this analysis. Check it out to get a detailed breakdown of EVER Token and its tokenomics model.

Introduction

Exciting news for Revenge fans and crypto enthusiasts alike! Everreach Labs has finally unveiled the official tokenomics for their native token, $EVER. As your go-to Excel wizard and crypto analyst, I’m here to break down these numbers and provide you with a comprehensive analysis of what this means for the Revenge ecosystem and potential investors.

Before we dive into the nitty-gritty of the tokenomics, it’s worth noting that this post is an update to my comprehensive review of Everreach Labs and Revenge. If you’re looking for more information about the game studio and their ambitious project, I highly recommend checking out that article first.

Key Takeaways

- EVER token has a total supply of 2,777,777,777 with a unique distribution strategy

- Multiple investment rounds: Seed ($0.0075), Private ($0.009), and Public ($0.0144)

- Initial Fully Diluted Valuation (FDV) of $20.8M for Seed round, attractive for early investors

- Significant token inflation over time, rising from 220M to 2.7B tokens in 60 months

- TGE success heavily dependent on market conditions and timing

- Project shows promise, but investors should be aware of inflationary pressures

- Potential for good returns if launched in favorable market conditions, but caution advised in current bearish sentiment

Announcement of the official $EVER Tokenomics

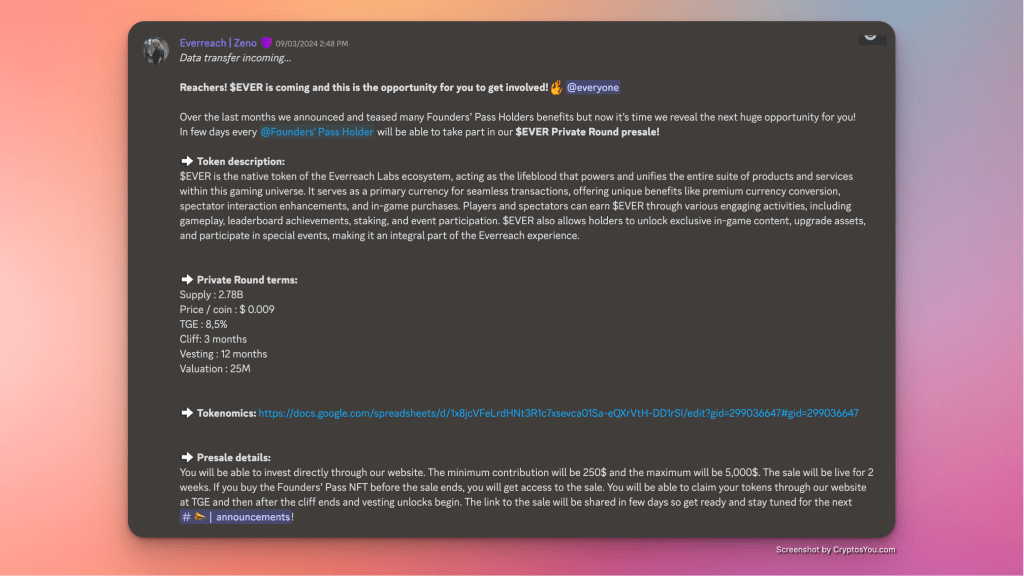

Below is the official announcement from the Revenge Discord server, detailing the $EVER token structure, presale terms, and tokenomics overview. This information comes directly from the development team, providing us with the foundation for our analysis:

Detailed $EVER Tokenomics Analysis

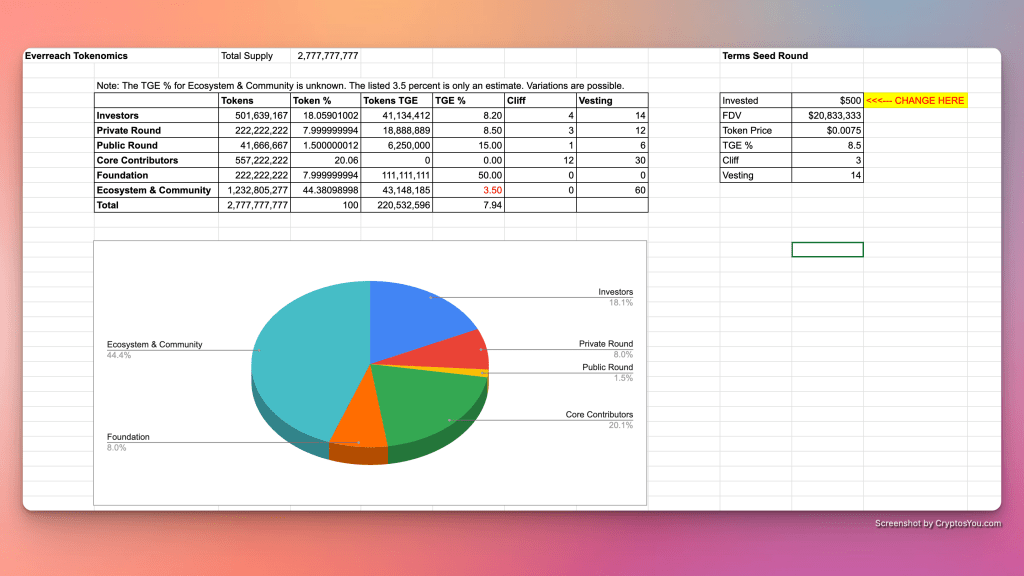

In this section, we’ll dive deep into the heart of the $EVER token economy. The Everreach team has provided a comprehensive document outlining their tokenomics, which serves as the foundation for our analysis. We’ll extract the key data from this document and break it down to understand what it all means for the EVER token and its potential holders.

For those who want to dive even deeper into the numbers and see the calculations behind our analysis, I’ve prepared a detailed Google Sheets document.

Overview of the $EVER token distribution

The EVER token boasts a unique total supply of 2,777,777,777 tokens, deviating from the standard 1 billion supply often seen in recent projects. This distinctive number adds a touch of individuality to the tokenomics.

Community-Centric Allocation

A significant positive aspect of the EVER tokenomics is the allocation of 44% to the Ecosystem and Community. This substantial portion demonstrates a commitment to community engagement and long-term ecosystem development.

Investor and Team Allocations

The tokenomics present a consolidated “Investors” category, encompassing various investment rounds such as Seed and Private sales. While this simplifies the overview, it also obscures some details of the early investment stages.

Core Contributors, presumably the team, receive 20% of the tokens. Importantly, these tokens are locked for 12 months, indicating a long-term commitment from the team and mitigating concerns of a quick profit grab.

Public and Private Sale Opportunities

The tokenomics outline both Private and Public sale rounds, providing opportunities for retail investors to participate. It’s worth noting that some investors had the chance to join a Seed round with even more favorable terms a few months ago.

Ecosystem and Community Allocation Details (incl. Airdrop)

Within the 44% allocated to Ecosystem and Community, an airdrop is included. However, the exact percentage to be released at the Token Generation Event (TGE) is not specified. For calculation purposes, we’ve estimated that 3.5% of tokens from this category will be released at TGE. This estimation is crucial for understanding the initial circulating supply and potential market dynamics.

Initial Circulating Supply

Based on our calculations, including the estimated 3.5% release from the Ecosystem and Community allocation, approximately 8% of the total supply (about 220.5 million tokens) will be in circulation on day one. This aligns with typical practices observed in other tokenomics structures.

Foundation and Liquidity Provision

The Foundation allocation is designated for providing liquidity on decentralized exchanges (DEXes). 50% of these tokens will be available on day one, ensuring sufficient liquidity for trading on platforms like Uniswap. The release schedule for the remaining 50% is not specified, but our calculations assume a six-month distribution period.

Important Note:

It’s crucial to highlight that the 3.5% TGE release for the Ecosystem and Community allocation is an estimate. The exact figure has not been disclosed by the Everreach team, and this assumption significantly impacts our circulation and market cap projections.

In the next section, we’ll delve deeper into the Seed Investment rounds, pricing, and various market cap scenarios to provide a comprehensive understanding of EVER’s potential in the market.

$EVER Token Investment Rounds: From Seed to Public Sale

The EVER token launch is structured across multiple investment rounds, each offering different entry points for investors. Let’s break down these rounds and their respective terms.

Seed Round: The Early Bird Opportunity

The Seed Round, held in July, offered the most attractive terms for early investors through the Q42 platform. For those interested in a more detailed look at the Q42 platform, we’ve prepared an in-depth review.

Here are the key details:

- Token price: $0.0075

- Fully Diluted Valuation (FDV): $20M

- TGE release: 8.5%

- Vesting: 3 months cliff, followed by 14 months linear vesting

Private Round: Exclusive Access for Founders’ Pass Holders

The ongoing Private Round is exclusively available to Founders’ Pass NFT holders, offering slightly different terms:

- Token price: $0.009

- Fully Diluted Valuation (FDV): $25M

- TGE release: 8.5%

- Vesting: 3 months cliff, followed by 12 months linear vesting

- Minimum investment: $250

- Maximum investment: $5,000

- Sale duration: 2 weeks

Public Round: The Final Opportunity

While details are limited, we know the Public Round will offer:

- Token price: $0.0144

- Fully Diluted Valuation (FDV): $40M

Investment Round Comparison

Here’s a table comparing the different investment rounds:

| Details | Seed Round (July) | Private Round | Public Round |

|---|---|---|---|

| Token Price | $0.0075 | $0.009 | $0.0144 |

| Fully Diluted Valuation (FDV) | $20M | $25M | $40M |

| TGE Release | 8.5% | 8.5% | N/A |

| Cliff | 3 months cliff | 3 months cliff | N/A |

| Vesting | 14 months linear | 12 months linear | N/A |

Analysis and Personal Thoughts

While the Seed Round offered the most attractive entry point, the Private Round still presents a compelling opportunity. The difference in price is relatively small, and the FDV of $25M for the Private Round remains attractive in my opinion.

In my Excel calculations, I’ve used the Seed Round terms as a baseline. However, you can easily adjust the figures based on your investment round (Private or Public) by changing the price and investment amount in the spreadsheet. This will automatically update all calculations.

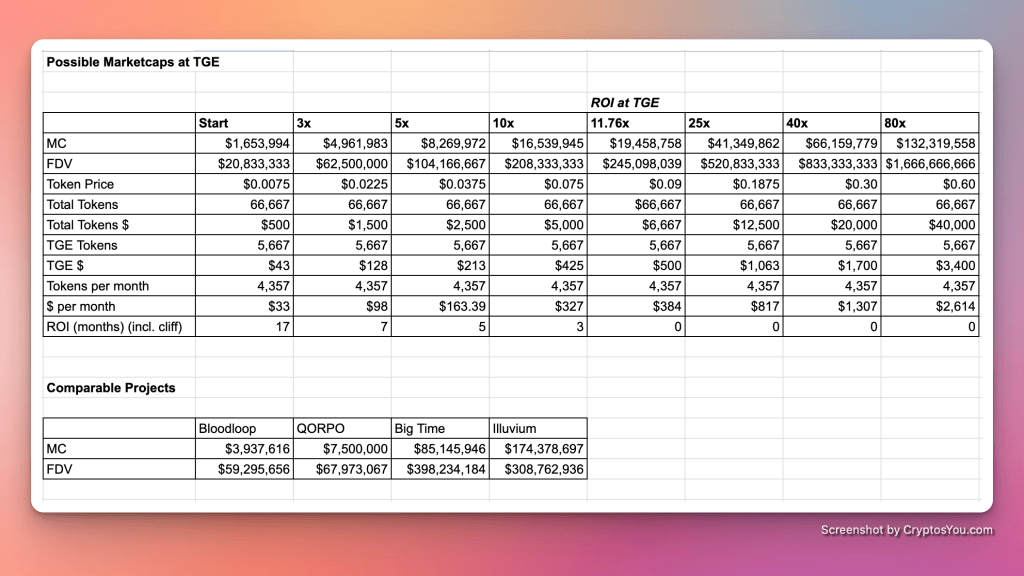

TGE Analysis and Market Cap Projections for EVER Token

Initial Market Cap Scenarios

For the Seed Investment, we start with a Fully Diluted Value (FDV) of $20.8 million. This translates to an initial market cap of approximately $1.6 million at the Token Generation Event (TGE), presenting an attractive entry point for investors.

In our example scenario:

- Investment: $500

- Total tokens received: 66,667

- TGE release: 5,667 tokens

- Monthly release post-cliff: 4,357 tokens

Return on Investment (ROI) at TGE

A crucial metric for investors is achieving ROI at TGE, meaning recouping the entire investment amount immediately. For our Seed Investment example:

- Required market cap for ROI at TGE: $19.5 million

- Corresponding FDV: $245 million

- Necessary price increase: 11.7x

At this level, investors would recover their $500 investment at TGE and receive approximately $384 monthly post-cliff. However, it’s important to note that these figures are theoretical and subject to change due to market dynamics.

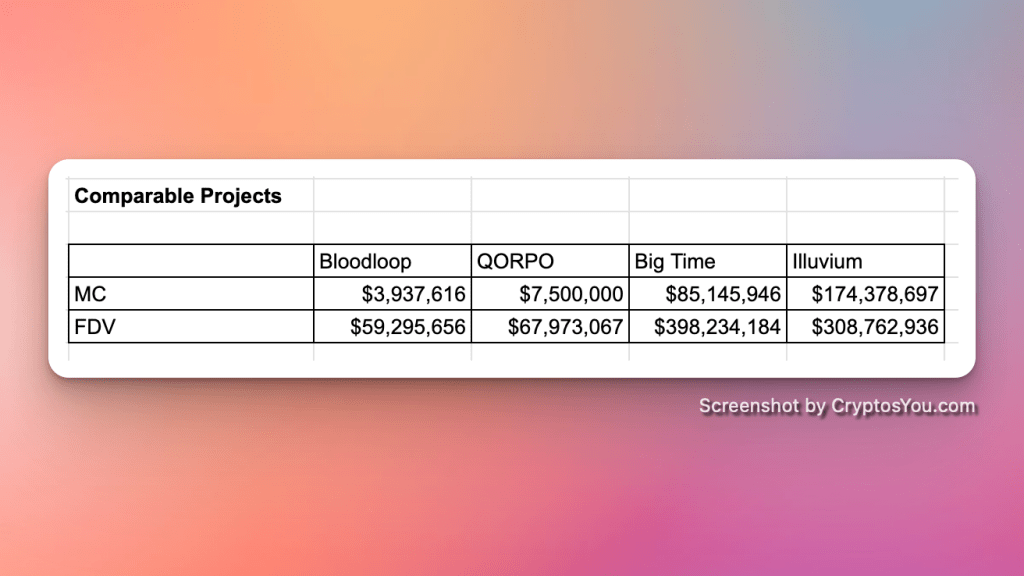

Market Conditions and Comparable Projects

Current market conditions play a crucial role in projecting potential outcomes. We’re currently in a mini bear market within a broader bull market, which may impact private and seed investments negatively.

To estimate potential market caps at TGE, it’s useful to look at comparable projects:

Factors Affecting Market Cap Projections

Several factors can influence the actual market cap at and post-TGE:

- Overall crypto market sentiment

- Bitcoin’s performance (potential new all-time high)

- Timing of EVER token launch

- Investor interest in buying the Token

Important Considerations

- The market cap projections in our table are most accurate for the first day and immediate post-TGE period.

- Token inflation will continuously affect these numbers as new tokens enter circulation.

- Current market sentiment towards seed investments is low, so expect a lower starting Market Cap

- A shift in market sentiment could lead to significantly higher multiples.

As a savvy investor, it’s crucial to stay aware of the current market phase and adjust expectations accordingly. While projects like Big Time or Illuvium demonstrate the potential for high market caps, achieving such numbers requires an improvement in overall market sentiment.

Remember, these projections are based on current data and market conditions. Always conduct your own research and consider the evolving nature of the crypto market when making investment decisions.

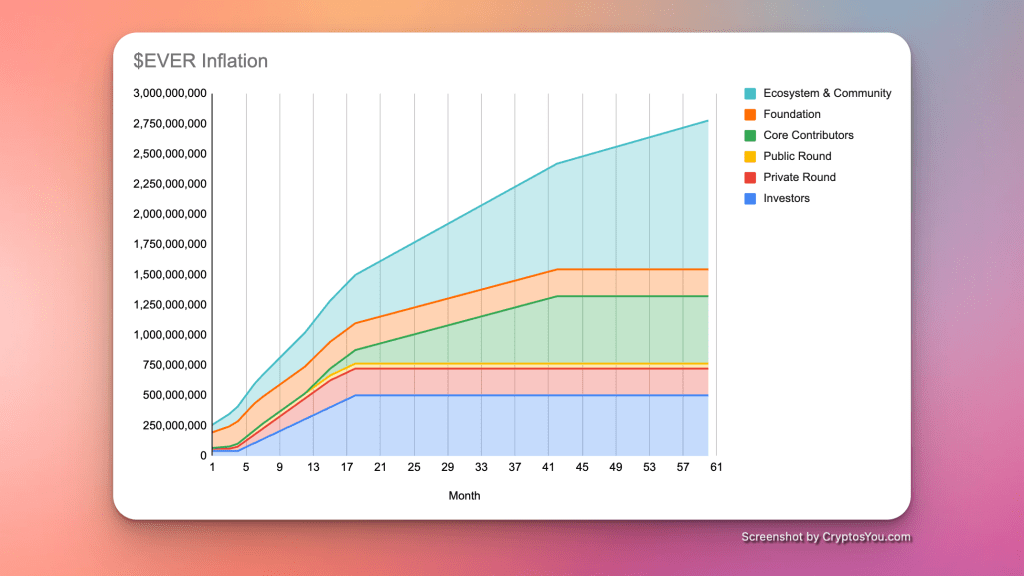

$EVER Token Inflation Analysis

In this section, we’ll examine the inflation rate of the $EVER token based on the data provided by the Everreach team. I’ve created an $EVER Inflation Diagram to visually represent this data, which you’ll find below.

Understanding $EVER’s Inflationary Trend

The diagram clearly illustrates a significant inflationary trend for the EVER token. Unfortunately, this aligns with the current trend seen in many cryptocurrency projects, where highly inflationary tokenomics are becoming increasingly common. It’s crucial for investors to consider this factor when making investment decisions.

To put this into perspective:

- Initial circulating supply at TGE: Approximately 220 million EVER tokens

- Projected supply after 60 months: 2.7 billion EVER tokens

This represents a massive increase in the token supply over a five-year period.

Mitigating Inflation Effects

To combat the effects of high inflation, several factors will be crucial:

- Fresh Capital Inflow: New money entering the market to purchase $EVER tokens can help maintain or increase the token’s value despite the growing supply.

- Bull Market Conditions: A broader cryptocurrency bull market could drive increased interest and investment in $EVER, potentially outpacing the inflationary pressure.

- Project Development and Adoption: Continued development of the Everreach ecosystem and increased user adoption could create more utility and demand for the $EVER token.

- Token Burning Mechanisms: If implemented, token burning could help reduce the overall supply and counteract some of the inflationary effects.

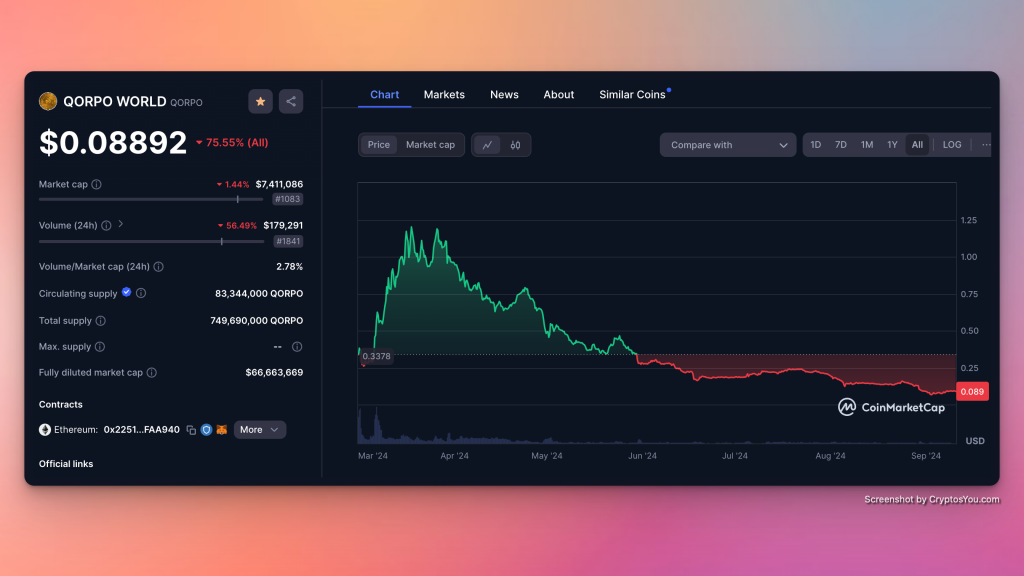

If these mitigating factors are not implemented or if market sentiment doesn’t shift favorably, we risk seeing a scenario similar to the recently launched QORPO token, where the token price suffered significantly due to inflationary pressures.

Conclusion

As detailed in my comprehensive review of Everreach and Revenge , I remain optimistic about the project’s potential. The EVER token, while following the current trend of inflationary tokenomics, offers an attractive entry point with its low initial Fully Diluted Value of $20 million.

However, investors should be mindful of the significant inflation rate and the token’s sensitivity to broader market trends. The success of EVER will largely depend on the Everreach team’s ability to time the Token Generation Event effectively and drive sustained demand in varying market conditions.