Introduction

Are you curious about the factors that determine the initial price of a cryptocurrency? If so, you’re not alone. The price of cryptocurrencies can fluctuate wildly, and understanding what influences these changes can be crucial for investors and traders.

In this article, we’ll explore the key factors that determine the initial price of a cryptocurrency. We’ll cover everything from supply and demand dynamics to market capitalization and investor sentiment. By the end of this article, you’ll have a better understanding of what drives cryptocurrency pricing.

Key Takeaways:

- The initial price of a cryptocurrency is determined by various factors.

- Supply and demand dynamics play a crucial role in determining the value of a cryptocurrency.

- Market capitalization and investor sentiment can also impact the price of a cryptocurrency.

- Utility and adoption can increase the demand for a cryptocurrency, driving up its price.

- Volatility and speculation can attract traders and speculators, impacting the short-term price of a cryptocurrency.

Supply and Demand: The Key Factors Influencing Crypto Pricing

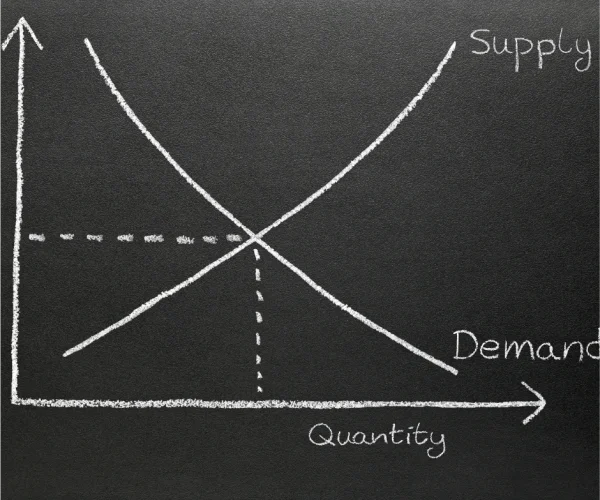

Now that you understand the importance of understanding how the initial price of a cryptocurrency is determined, it’s time to delve into the specific factors that influence crypto pricing. The most significant of these factors is the basic economic principle of supply and demand.

Supply refers to the total amount of a cryptocurrency that is available for trading, while demand refers to the desire of investors to obtain a particular cryptocurrency. When the demand for a cryptocurrency is higher than its supply, its price increases. Conversely, when the supply exceeds demand, the price will decrease.

It’s important to note that supply is limited in the case of most cryptocurrencies. Bitcoin, for example, has a maximum supply of 21 million bitcoins, which means that there will only ever be 21 million in existence. This limited supply increases its value and the demand among traders and investors willing to pay a premium price for it.

The value of a cryptocurrency is largely determined by the demand from investors. A cryptocurrency that is in high demand will have a higher price, and one that is less in demand will have a lower price. The demand for a cryptocurrency is influenced by several factors, including its usability, market perception, overall adoption, and underlying technology.

In conclusion, supply and demand are the key drivers of cryptocurrency pricing. Understanding how supply and demand dynamics work in the context of cryptocurrency trading can help you make more informed investment choices and maximize your profits.

Market Capitalization and Investor Sentiment

Another factor that plays an important role in determining the initial price of a cryptocurrency is market capitalization. Market cap refers to the total value of a cryptocurrency and is calculated by multiplying its current price with its total circulating supply.

Investor sentiment is another important factor in determining the price of cryptocurrencies. Positive or negative sentiment among investors can affect the demand for a cryptocurrency, thereby influencing its price. For instance, if investors perceive a cryptocurrency as a sound investment, they would be more likely to buy it, increasing its demand and driving up its price.

Investors in cryptocurrencies are also influenced by news and announcements related to the cryptocurrency market. For instance, news about significant investments in a cryptocurrency or its adoption by major companies can boost investor sentiment and increase the demand for the cryptocurrency.

| Investment | Trader |

|---|---|

| Investors | Traders |

| Long term | Short term |

Investors typically take a long-term view of the cryptocurrency market, while traders are more interested in short-term price movements. Traders can have a significant impact on the price of cryptocurrencies due to their high trading volumes and the high level of volatility in cryptocurrency markets.

High volatility in cryptocurrency markets can also attract speculators, who are looking to make quick profits from the price movements of cryptocurrencies. Speculators can further increase the demand for a cryptocurrency, driving up its price in the short term.

Understanding how market capitalization and investor sentiment affect the price of cryptocurrencies is important for investors and traders alike. By monitoring these factors, you can make better-informed investment and trading decisions in the cryptocurrency market.

Utility and Adoption: Factors Affecting Crypto Pricing

When it comes to determining the initial price of a cryptocurrency, utility and adoption are essential factors. The utility of a cryptocurrency refers to its usefulness in real-world applications, while adoption reflects the number of businesses and individuals using it for transactions or investments.

The more a cryptocurrency is used and accepted by people, the higher the demand for it will be, which can increase its price. For instance, if a growing number of businesses start accepting a particular cryptocurrency as a payment method, its adoption rate will increase, positively impacting its value. A good example is Bitcoin’s growing acceptance as a payment method by major corporations.

Furthermore, the utility of a cryptocurrency can also influence its price. If a cryptocurrency has a unique feature that makes it more useful or efficient than other digital currencies, it is likely to attract more investors and traders, increasing its demand and value in the process. For example, Ethereum’s smart contract technology has made it a more versatile cryptocurrency, leading to increased adoption and overall demand.

On the other hand, if a cryptocurrency has limited use cases or is not widely adopted, its value and price may not rise as significantly. This is why it is important to research the potential utility and adoption of a cryptocurrency before investing in it.

Volatility and Speculation: Influencing Factors in Crypto Pricing

When it comes to determining the initial price of a cryptocurrency, volatility and speculation are two important factors to consider. Volatility refers to the degree of price fluctuation that a cryptocurrency experiences over a period of time. Speculation, on the other hand, refers to the act of buying and selling a cryptocurrency with the hope of making a profit based on anticipated price movement.

The high level of volatility in cryptocurrency markets can attract traders and speculators, influencing the price in the short term. Digital currencies are known for their rapid price movements, which can be caused by a variety of factors such as market news, regulations, and even tweets from prominent figures in the industry.

Traders and speculators can take advantage of this volatility by buying and selling cryptocurrencies at the right time. For example, if a trader anticipates a price increase, they might buy a cryptocurrency in hopes of selling it later at a higher price, making a profit from the price difference.

Although speculation can be a driving force behind price movements, it is important to note that it can also lead to price bubbles and crashes. When the market becomes overheated with speculation, it can cause prices to become disconnected from the actual value of the cryptocurrency, resulting in a bubble. Once the bubble bursts, prices can crash rapidly, leaving many traders with losses.

Overall, volatility and speculation can have a significant impact on the initial price of a cryptocurrency. Keeping up with market news and trends, conducting thorough research, and being cautious when trading can help you make informed decisions and minimize risks.

“The high level of volatility in cryptocurrency markets can attract traders and speculators, influencing the price in the short term.”

Conclusion

Understanding how the initial price of a cryptocurrency is determined is crucial if you want to invest in this market. The factors that influence crypto pricing are complex and interconnected, making it essential to consider all of them before making any investment decisions.

Supply and demand, market capitalization and investor sentiment, utility and adoption, and volatility and speculation all play a role in determining the initial price of a cryptocurrency. By analyzing these factors, you can get a better understanding of the value of the cryptocurrency and its potential for growth.

Keep in mind that the cryptocurrency market is highly volatile and can change rapidly, so you should always do your research and invest wisely. By understanding how the initial price of a cryptocurrency is determined, you can make informed decisions and increase your chances of success in this exciting and dynamic market.

So, remember to analyze all the relevant factors, keep up with the latest developments, and invest wisely.

FAQ

Q: How is the initial price of a cryptocurrency determined?

A: The initial price of a cryptocurrency is determined by various factors, including supply and demand dynamics, market capitalization, utility and adoption, volatility, and speculation. These factors influence the perceived value and demand for the cryptocurrency, ultimately impacting its price.

Q: What role does supply and demand play in cryptocurrency pricing?

A: Supply and demand dynamics are key factors in determining the initial price of a cryptocurrency. Limited supply and high demand from investors can drive up the price of a cryptocurrency, while increased supply and low demand can have the opposite effect. Understanding the balance between supply and demand is crucial in assessing the potential value of a cryptocurrency.

Q: How does market capitalization and investor sentiment affect cryptocurrency pricing?

A: Market capitalization reflects the total value of a cryptocurrency, and positive or negative investor sentiment can greatly influence its price. If investors have confidence in the cryptocurrency and its potential for growth, it can drive up the price. Conversely, negative sentiment or market uncertainty can lead to a decrease in price.

Q: What impact does utility and adoption have on cryptocurrency pricing?

A: The utility of a cryptocurrency in real-world applications and its level of adoption by businesses and individuals can significantly affect its price. Increased utility and widespread adoption can create higher demand for the cryptocurrency, increasing its value and price. Conversely, limited utility and low adoption may result in lower demand and a decrease in price.

Q: How do volatility and speculation influence cryptocurrency pricing?

A: Volatility and speculation play a role in the initial price of a cryptocurrency. The high level of volatility in cryptocurrency markets can attract traders and speculators looking for short-term gains. Their actions can cause fluctuations in the price of a cryptocurrency. Speculative trading and market sentiment can impact the perceived value of a cryptocurrency in the short term.